Unveiling the Costly and Potentially Disastrous Mistakes Homeowners Make When Choosing

Buying a home is a major financial decision, and one that should not be taken lightly. There are many factors to consider, from the location and size of the home to the price and financing options. Unfortunately, many homeowners make costly mistakes when choosing a home, which can lead to financial hardship and even disaster.

In this article, we will discuss some of the most common mistakes that homeowners make when choosing a home. We will also provide tips on how to avoid these mistakes and make an informed decision that safeguards your investment and well-being.

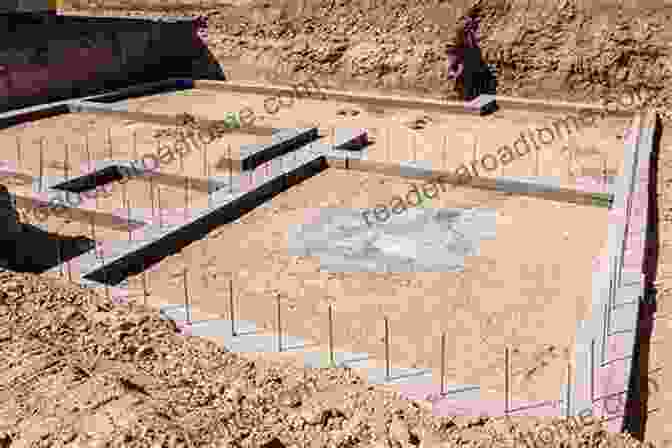

1. Not Getting a Home Inspection

One of the biggest mistakes that homeowners make is not getting a home inspection before purchasing the property. A home inspection is an objective assessment of the condition of a home, and it can identify potential problems that could lead to costly repairs or even make the home unlivable.

There are many different types of home inspections, but the most common is a general home inspection. A general home inspection will typically cover the following areas:

- Structural components (e.g., foundation, walls, roof)

- Exterior components (e.g., siding, windows, doors)

- Interior components (e.g., plumbing, electrical, HVAC)

- Appliances (e.g., refrigerator, stove, dishwasher)

The cost of a home inspection will vary depending on the size and age of the home, as well as the inspector's fees. However, the cost of a home inspection is a small price to pay for peace of mind, and it could save you a lot of money in the long run.

2. Not Getting a Title Search

Another common mistake that homeowners make is not getting a title search before purchasing the property. A title search is a thorough examination of the public records to determine who owns the property and whether there are any liens or other encumbrances on the title.

A title search is important because it can reveal problems with the title that could affect your ownership of the property. For example, a title search could uncover undisclosed liens or easements that could make it difficult or impossible to sell the property in the future.

The cost of a title search will vary depending on the location of the property and the complexity of the search. However, the cost of a title search is a small price to pay for peace of mind, and it could save you a lot of money in the long run.

3. Not Getting an Appraisal

An appraisal is an estimate of the value of a property. An appraisal is important because it can help you determine if the Free Download price of the home is fair. It can also be used to secure financing for the Free Download.

There are different types of appraisals, but the most common is a single-family home appraisal. A single-family home appraisal will typically include the following:

- An inspection of the property

- A review of comparable sales data

- An analysis of the local real estate market

The cost of an appraisal will vary depending on the size and age of the home, as well as the appraiser's fees. However, the cost of an appraisal is a small price to pay for peace of mind, and it could save you a lot of money in the long run.

4. Not Getting Loan Approval

Many homeowners make the mistake of not getting loan approval before starting their home search. This can be a costly mistake, as it can lead to disappointment and frustration if you find a home that you cannot afford.

Getting loan approval is a relatively simple process. You can apply for loan approval online or through a mortgage broker. The lender will review your financial information and determine how much you can afford to borrow.

Once you have loan approval, you will be in a much stronger position when you start your home search. You will know how much you can afford to spend, and you will be able to focus your search on homes that fit within your budget.

5. Not Getting Insurance Coverage

Homeowners insurance is a type of insurance that protects your home and its contents from damage or loss. Homeowners insurance is important because it can help you financially recover from unexpected events, such as fires, floods, and earthquakes.

The cost of homeowners insurance will vary depending on the location of the property, the age of the home, and the amount of coverage you choose. However, the cost of homeowners insurance is a small price to pay for peace of mind, and it could save you a lot of money in the long run.

Buying a home is a major financial decision, and one that should not be taken lightly. There are many factors to consider, and it is important to do your research and make informed decisions.

By avoiding the common mistakes that homeowners make when choosing a home, you can safeguard your investment and well-being. You can also save yourself a lot of money in the long run.

If you are planning to buy a home, we recommend that you consult with a qualified real estate agent. A real estate agent can help you find the right home for your needs and budget, and they can guide you through the home buying process.

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Rudyard KiplingMaking the Delicious Turkish Food: A Culinary Journey to the Heart of Turkey

Rudyard KiplingMaking the Delicious Turkish Food: A Culinary Journey to the Heart of Turkey August HayesFollow ·17k

August HayesFollow ·17k Jack LondonFollow ·10.5k

Jack LondonFollow ·10.5k Federico García LorcaFollow ·16.2k

Federico García LorcaFollow ·16.2k Avery SimmonsFollow ·16.6k

Avery SimmonsFollow ·16.6k Jamie BlairFollow ·2.7k

Jamie BlairFollow ·2.7k Ruben CoxFollow ·9.6k

Ruben CoxFollow ·9.6k Dan BrownFollow ·19.7k

Dan BrownFollow ·19.7k Douglas FosterFollow ·5.9k

Douglas FosterFollow ·5.9k

Brady Mitchell

Brady MitchellUnveiling the Apprehended Vital Truth for the Bride of...

In the tapestry of life, where trials and...

Eric Nelson

Eric NelsonDivine Energy Harmony Way: Embracing the Power Within for...

In the realm of personal...

Robert Louis Stevenson

Robert Louis StevensonUnlock the Secrets of Calf Growth and Development: A...

Are you an aspiring...

Gerald Parker

Gerald ParkerPhysician Life In The Shadow Of Polio: A Harrowing and...

A Riveting Tale of Determination Amidst a...